The San Antonio investment property market has really heated up in the last 18 months. Back in 2014, it was possible to buy houses for $30,000, do $10,000 in rehab at most, and owner finance them for $59,000.

Or, you could buy an under market value property for $40,000, do $10,000 in rehab, and flip it for cash and make $30,000.

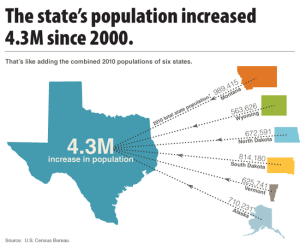

Making money in San Antonio investment property is still very possible and I do it every week, but it is more challenging now. The economy has improved a great deal, and San Antonio TX is a booming market, with great numbers of people moving here every month. With all of the construction going on, there is plenty of blue collar job demand.

Lower gas prices have also put more money in people’s pockets, which leads to more economic growth and spending.

All of this has led to an increase in real state prices in my under market value properties.

But, the good news is that because I have been doing this for 15 years and I know how to rehab properties and negotiate investment property deals, I still am able to make excellent returns on flips.

I mostly am a buy and hold investor with owner financing, but I have been doing some extremely profitable flips these days. My work crew loves when I do flips because they pay well, and I like them because they are profitable for me!

I have a current flip that the investor would make $12,000 on, which is fantastic in this hot market. This house is listed below:

- Address: 2229 W Hermosa Dr. San Antonio, TX 78201

- Year Built: 1948

- Description: Under market value property sale in hot north of downtown neighborhood, 2 beds 1 bath, 769 sqft, built: 1948, lot size: .14 acres yearly taxes: $1,200.00, estimated yearly insurance: $800.00, estimated repairs on this distressed sale.

- Rehab Option#1: 35K, includes new HVAC, converting to 3 BR, updated kitchen, flooring, paint in/out, exterior skirt, roof, room addition, appliances, paint out door storage exterior, trash, lawn maintenance.

- Max After Repair Value: $139,000.00 with owner financing, comps are for 3/1.

- Rehab Option #2: 15k AC, flooring paint in and out $109,000 ARV.

- Cash Price: $69,900 firm.

This house is located in a hot area north of downtown and is an excellent under market value fixer upper. I was able to get a very reasonable price of $69,900 on this deal.

Of course if I didn’t know what i was doing, this wouldn’t work. Most under market value property investors spend too much on rehab, which kills the deal. I know exactly how much rehab to do on this project – flooring, HVAC, paint in and out, and resell it. By doing that amount of rehab, this will resell for approximately $109,000. Quite a nice flip in this hot San Antonio market!

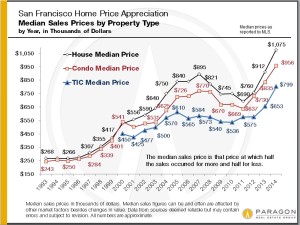

Try to do this type of flip with San Francisco investment property, Seattle investment property, Los Angeles investment property or San Diego investment property 🙂