If you are considering to purchase under market value, out of state investment property, you probably will be considering the state of Texas as a possibility. Texas generally offers some great benefits for out of state property investors and has some of the best cities to invest in real estate.

- No state income tax for people or corporations

- Landlord and owner friendly

- Pro business environment (Texas rates highly among small businesses for regulatory and license simplicity and low taxes)

- Fast foreclosures (this is especially important if you are an owner finance property investor!)

Forbes recently recognized Texas as a great place to buy under market value investment properties. In fact, FOUR of its Top 10 Best Buy Cities in 2015 for real estate were in Texas. Forbes analyzed more than 300 housing markets and Texas turned out to be a great place to invest in real estate. Let’s take a look at each one:

#1 Austin

Forbes rated Austin #1 in its Top 10 Best Cities to Invest in for 2015 with its impressive population growth of 8.9% and job growth of 3.6%, which is far better than the national average of 2%.

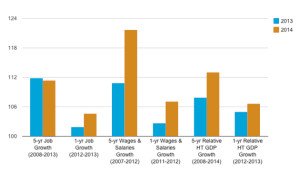

Milken Institute’s Growth Comparison for Austin, 2nd Best-Performing City in US in 2014

More figures about Austin to consider for out of state property investors:

- MSA is Austin/Round Rock TX

- Population is 1.8 million

- Average home price is $261,000

- Population growth from 2010-13 was 8.9%

- Job growth annually is 3.6%

- Unemployment is 4.2%

- Home price to rent ratio is 19

Of course all this growth is driving housing prices higher. Austin house prices are 8% over the typical income for the region. But under market value investors should take heart because the higher house prices in this area are due the demand, not a housing bubble and over inflation.

Austin is not reliant upon energy for most of its economy so the oil crash should not be a major factor here.

#3 Houston

MSA is Houston-Bayton-Sugarland TX. As is the case in Texas generally, Houston has a business friendly environment, no state income tax for people or corporations and a very educated population.

Houston investors made gross returns of 18% in 2015.

Houston also has strong growth in jobs, a booming population and low housing prices. The average price here currently is $214,000. Some experts say the housing market in Houston is still undervalued, so if you are looking for under market value property to invest in, you could do well in Houston.

Remember, in every real estate investment market, there is a strong correlation between the price of homes and the median income. When prices go high above that level, the market is overpriced and you will have a hard time finding under market value property that will produce passive income. If houses are under valued, you should feel confident that you will make a solid rate of return with investment property. Houston is a solid out of state property investment option.

Also note that the median age of inventory in 2015 for Houston was only 54 days.

I would watch to see what is going to happen to the Houston market in 2016 as oil prices continue to drop. Houston’s economy has a lot to do with energy exploration. The rental market is driven largely by transient oil and gas workers, so we’ll see how the Houston market responds to lower oil prices this year.

#5 Dallas

MSA is Dallas-Plano-Irving TX. The population of Dallas is growing at at least 6% per year and will continue for the next few years at least. It also has a job growth rate of 3%, and this is being driven by a boom in high tech companies. One of these is One Technologies LP, which is an online credit monitoring service that was ranked in 2014 as the quickest growing private firm in Dallas.

Investors made almost a 20% return here before expenses in 2015, which is due to strong appreciation in prices and high rents.

Under market value property investors should note that 13 privately held corporations worth $1 billion or more are in the Dallas metro area, such as Dean Foods, Exxon Mobil, Kimberly Clark, Neiman Marcus, Southwest Airlines and Texas Instruments.

In 2015, new home closings rose 20% in Dallas from a year earlier.

#6 San Antonio

MSA is San Antonio TX. San Antonio is where I have invested for most of my below market value investment career since 2001. I continue to invest in under market value properties here, rehab them and resell with owner financing. Here’s why I continue to believe that San Antonio is one of the best cities to invest in real estate:

- Prices are still low, even with the economic boom. The average home price here is $189,000. Even with higher prices, I still buy below market value properties for $50,000, do $25,000 in rehab and sell with owner financing for $99,000. That still makes me an 11% return, which is excellent passive income.

- Booming economy, with the biggest growth in construction employment from 2014 to 15. Even though oil prices have effectively crashed in the last year, I have no shortage of buyers for my under market value properties. Only 2-3% of our economy depends upon oil and gas. My workers may get laid off from oil work, but they find other blue collar employment.

- Strong job outlook, with a 3.5% job growth rate in 2015.

- Growing population – San Antonio is the #9 fastest growing city, according to Forbes. This means strong demand for owner finance and rental properties, and is a great option for out of state property investment.

If you want a good example of how good under market value investment properties can be in San Antonio, here is one:

This 3 BR 1.5 bath property investment with positive cash flow north of downtown San Antonio TX is in a heavily revitalizing area. It was bought by the investor for $62,000.

It only needed approximately $10,000 of rehab, including new flooring, paint in and out, and minor foundation work.

The total project cost to the investor was $72,000.

Within 50 days of the completion of rehab, it was sold with owner financing with the following terms:

- $5000 down

- $89,900 final price

- 10% interest

- 30 year note

- $937/month PITI

- Cap rate 12.3%