I have been investing in under market value properties in San Antonio TX for more than 15 years. Unlike many real estate investors, I did not start off with much cash, nor did I have a rich aunt who would loan me money at 8%.

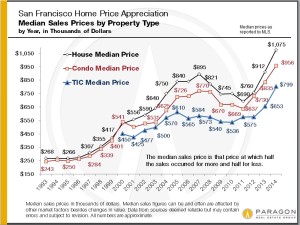

After I finished college, I tried to buy Boston investment property, Seattle investment property and San Francisco investment property, among others, but it was too expensive.

So I returned to Texas and started to invest in below market value properties that cost $20,000 to $30,000. I was amazed when I discovered San Antonio TX, and how one could generate substantial real estate cash flow each month on such inexpensive distressed properties.

I did make some money in the stock market, so in 2001, I was able to purchased my first under market value Texas property for only $30,000 cash. After I spend $5000 on rehab, I then made real estate cash flow of $600 per month on it as I rented it out. That was my first San Antonio investment property.

After that first under market value investment property, I didn’t have much capital left. So, I had to hunt for private money to borrow. It took a lot of phone calls, but I eventually tracked down an investor allowed me to borrow more than $1.5 million over three years to rehab and rent out under market value properties.

I would borrow $30,000 to $50,000 from my investor every few months to do a new deal, and I made about 10% in real estate cash flow on those deals.

After about five years, I was doing very well and had more than $10,000 per month in real estate cash flow, but I was getting weary of doing full rehabs and maintaining properties. That is when I started to use my current under market value investment model:

- I buy $30,000 to $60,000 below market value San Antonio investment property for cash.

- I do $10,000 to $30,000 in rehab (sometimes I will not repair the house at all).

- I resell the property to a blue collar worker with a $5000 down payment and a steady job.

- Typical terms on the below market value property are $5000 down, $800 per month PITI, $79,900 final price, 10% interest.

Investing in this way gives me real estate cash flow of 12% per year or more without doing the typical landlord repairs that most investors deal with.

I also give my end buyers the opportunity to own their own home. This type of investing has been my main method for almost 10 years. It is by buying under market value properties for cash in this way, and then owner financing them, that i have been able to generate more than $30,000 per month in real estate cash flow.

To give you a good example of how I do these types of under market value deals with San Antonio investment property, here is a great case study we just completed:

My out of state investment property investor bought this ‘junk’ house for $25,000 in November:

It had sat empty for years and was part of an estate sale. Now this house was ugly, no question about it. But it is located in an up and coming neighborhood in 78207, where the city of San Antonio has spent millions of dollars putting in running trails, parks, shopping plazas, green space and so on. This ‘junk’ house is only 2 miles from downtown and all the tourist attractions of the city.

Yet this under market value house sat for months and no investor wanted it. I grabbed it and quickly resold it to an out of state investment property investor.

Right next door to this ‘junk’ house were these owner occupied homes:

Those houses right next door are worth more than $100,000, but no one wants my under market value ‘junk’ house because it’s temporarily ugly:

The conventional investor wanting real estate cash flow cannot see past the ugliness, but I saw the potential here because of the neighborhood revitalization and the nice houses around it.

So, I sold this house for $25,000 to an out of state investment property investor who did $27,000 in rehab (which I did for him in 30 days), which included:

- Electrical update

- New flooring (float new floor over that minor foundation issue after it’s repaired)

- Clean out

- Update bath and kitchen with tile and granite

- New light fixtures

- Paint in and out

- Finish second bedroom

Note that I own a construction company, and my rehabs are typically 2/3 of the price of most companies’ rehabs.

Below are the after rehab pics:

The ARV on this below market value property is $79,900. We just finished the rehab in the middle of January 2016. And, by early February, we already had an owner finance buyer for it: $5000 down, $850 per month, $79,000 final price, 10% interest, 30 year note.

The house was on the market for less than a month. So on a $52,000 investment, the out of state property investor will earn about 16% ROI with no more repairs because we owner financed the house.

This is the kind of under market value investing I do – I buy ‘junk’ houses that other investors reject and turn them into little gold mines.

This type of property is great for real estate cash flow, and is far superior to what is available to most investors looking for Seattle investment property or San Francisco investment property. That’s probably why most of my out of state investors are from Seattle and San Francisco! I also have many former buyers of California investment property generally who only buy my San Antonio investment property now.