The spring selling season has started in San Antonio, and home buyers and investors looking for properties should expect to pay more, no matter if you’re buying a $50,000 under market value property or a $1 million mansion.

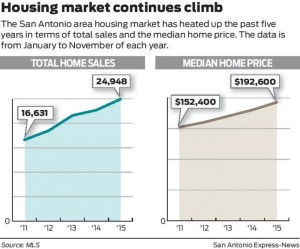

A recent study revealed the annual appreciation of homes in San Antonio is between 7-8% as of February, compared to a year ago.

Lower-priced homes in San Antonio saw an 8% rise, with a typical price of $153,000. For homes up to $226,000, the rate was 8%. Home values in more expensive homes above $366,000 grew 7.3%.

Also, the median price of sold homes in San Antonio increased 12% in March 2021 to $268,000, with the average of 45 days on the market, which is down 35% from last year.

We’re seen such an increase in prices this year that some worry we might be looking at a housing bubble like 2008. But this doesn’t seem likely; the conditions causing the increase this time are different, so we’re probably in for a steady rise for the foreseeable future.

Excess lending is largely what drove the 2006 and 2007 bubble. But lending standards are tighter now. Most buyers need higher FICO scores and down payments, and debt to income ratios are tighter.

Also, there still is a shortage of homes in San Antonio; the inventory dropped to only 1.3 months in March 2021. That’s well below the typical six month supply that is thought to be a good balance between buyers and sellers.

Another factor reducing supply – and this is something that should concern investors looking for San Antonio wholesale properties – is high material costs. Prices have tripled since 2020 with the average cost of a new San Antonio home almost $400,000.

Available land is scarce and more expensive, and the permitting process is taking longer.

More people are moving into Texas from more expensive areas, drawn to the lower real estate and living costs. Real estate investors are buying up a lot of under market value real estate properties in San Antonio, too. This increases prices.

But while you will pay more for San Antonio wholesale properties, you can charge a higher price when you owner finance or rent it.

Here at Texascashflow.com, we’re currently searching for new deals that meet our criteria. Don’t worry – we’ll have our listings updated soon with more fantastic wholesale investment properties.