Before the market crash, two of our biggest investors owned more than 100 rental properties. Like many investors, they once thought that owning rental properties was the only way to make money in real estate investing.

What they found was that they were often dealing with repair problems. It didn’t matter that they had property managers. When you own 100 houses, you always have to deal with a repair, a late bill, a vacancy, paperwork and so on.

They also found it was hard to know what their cash flow on each house was each month. Writing checks for new water heaters and fridges gets old fast!

It was around 2009 that one of our investors’ mentors talked to them about switching to owner finance so they could retire with millions in real estate. That mentor only did owner finance homes.

Rather than being a landlord responsible for property upkeep and repairs, there are more efficient ways to generate monthly cash flow.

Be the Bank!

Think about your own house. Each month you send an electronic payment (or check) to your mortgage company or bank. Your bank doesn’t have to maintain the property – you do. Since you are buying the property from the bank on terms, it is natural to your benefit to maintain the property. The bank knows that statistically, homeowners are much more likely to keep their houses in good repair than renters. That’s what makes holding mortgage notes so attractive.

Our mentor taught our investors they could be the bank for people who do not have the credit history to qualify for a regular mortgage loan. The investor carries the loan on the distressed property for 30 years just like the bank, and the new owner of the house simply pays a mortgage payment each month that includes taxes and insurance.

The mentor said to our investors – why should you spend $10s of thousands on rehabbing a property when you can have the end buyer do most of it? Owner finance investment property is smart.

The end buyer usually has a vested interest in maintaining their property, as they own it.

How a Typical Owner Finance Property Deal Looks:

$62,000 cash purchase, $10,000 rehab, 50 DOM, sold for $89,900 owner finance, $937 per month, 12.3% ROI.

This 3 BR 1.5 bath property investment with positive cash flow north of downtown San Antonio TX is in a heavily revitalizing area. It was bought by the investor for $62,000.

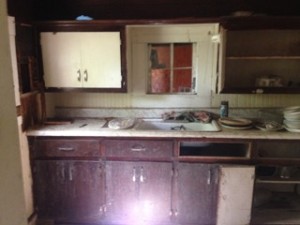

The under-market value property only needed approximately $10,000 of rehab, including new flooring, paint in and out, and minor foundation work.

The total project cost to the investor for this under-market value property was $72,000.

Within 50 days of the completion of rehab, it was sold with owner financing with the following terms:

- $5000 down

- $89,900 final price

- 10% interest

- 30 year note

- $937/month PITI positive cash flow

- Cap rate 12.3%

After our investors converted most of their under-market value properties to owner finance, most of of their worries about properties disappeared. The owner maintains it and the investors simply enjoy the monthly cash flow from each property into their bank accounts.

Most people don’t seem to ever consider owner financing their property investment, probably because they don’t know about it.

The keys to success in owner finance property are simple:

- Carefully documenting the income of the potential buyer and verifying their work history

- Follow the Dodd Frank law, which mandates that you must collect proof of their income and document their work history.

- You can have a Texas licensed loan originator do this for you for a $750 or so fee (we have one on staff).

The bottom line on owner finance investment property is you enjoy cash flow without maintenance and the buyer enjoys buying their own home at last – a true win-win for everyone.